How Private Equity Killed the American Dream

How Private Equity Killed the American Dream

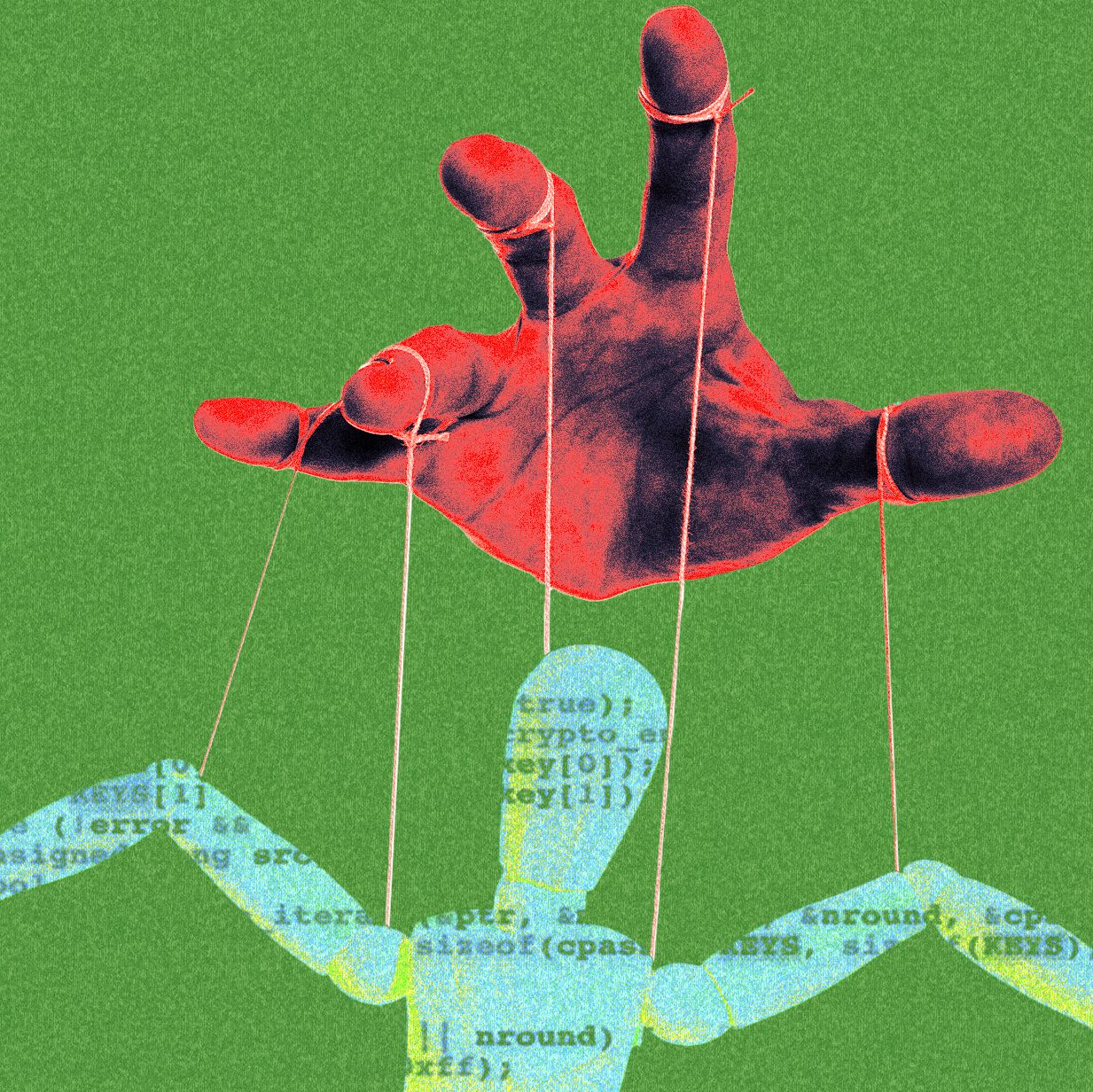

Private equity firms have played a significant role in changing the landscape of the American economy. These firms acquire companies using large amounts of debt, restructure them, and sell them for a profit. While this business model can be lucrative for investors, it often comes at the expense of employees and long-term sustainability.

One of the ways private equity firms kill the American dream is by prioritizing short-term gains over the well-being of workers. They often implement cost-cutting measures such as layoffs, wage freezes, and benefit reductions to boost profits. This can lead to job instability, financial stress, and decreased employee morale.

Additionally, private equity firms have been known to load acquired companies with debt, making it difficult for them to invest in innovation, research, and development. This lack of investment can hinder long-term growth and competitiveness, ultimately hurting the American economy.

Furthermore, the emphasis on maximizing profits can lead to the neglect of social responsibility and ethical business practices. Private equity firms may prioritize financial returns over environmental sustainability, employee well-being, and community engagement, further eroding the American dream.

In conclusion, private equity has had a significant impact on the American economy, often at the expense of workers, innovation, and long-term sustainability. By prioritizing short-term gains and neglecting social responsibility, these firms have contributed to the erosion of the American dream for many individuals and communities.